Compliance SAAS Software Development – MEAN Stack

The world is constantly changing. So are the laws, policies, and standards of any organization. Today’s Compliance managers are therefore in need of robust and effective compliance management software solutions, to stay on the top of the swiftly changing regulations and the new norms.

According to Deloitte’s Global Risk Management Survey,

- 79percent of the C-suitors believed their institutions are in dire need to enhance the quality of risk data.

- 68percent are looking forward to enhancing the risk information systems and infrastructure.

As a result, the community of developers has come up with several solutions pertaining to demands for analyzing the risk factors for almost every industry. Compliance management software for banks offers a powerful solution to manage a wide variety of compliance and regulatory processes to ensure accountability throughout banks of every size.

As a leading SaaS development agency, the Node Js development team at The Brihaspati Infotech had the opportunity to serve a custom Bank Compliance management software for one of our esteemed clients. We have continued to serve them over a long period helping them establish tailor-made software, finely to their existing infrastructure.

Through this blog, we will learn more about the development approach for custom compliance management solutions, and how we managed to resolve the complex processes.

The need for developing a custom bank compliance management software

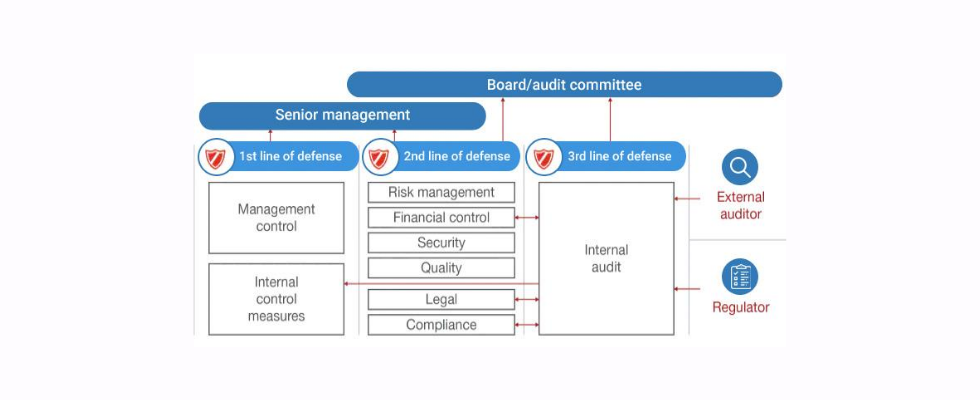

Compliance management in an organization is carried out in a structured manner. The complex process of analyzing risk and audit sessions is broadly divided into three lines of Defence, as explained by PWC:

The software solution is supposed to keep a check on the lines of defense and their responsibilities. Clearly, the roles are many with a variety of access to the information. The steps to perform an ideal audit are meant to vary from an institution to another.

The pre-designed tools limit the abilities of the compliance managers to a confined number of features. Added to the dire need for carrying out limitless operations with the compliance management software, our client was skeptical about the security of data and information shared at the time of auditing.

At this, our compliance software development company assured a full-fledged software tailored for the client’s existing infrastructure along with the much-needed data security over the cloud.

Building compliance management system with Node JS

We led the development of banking compliance software using Node JS. Node Js offers a robust platform to develop web applications that can be easily scaled vertically as well as horizontally allowing the developers to add features that really count.

At the frontend, we have used Angular for banking compliance software development. Angular enables our developers to create a dynamic web application based on a model-view-controller (MVC) architectural pattern and using HTML as a template language. Paired with NodeJS, helped us to build a scalable server-side application.

The dedicated team of 3 highly experienced developers led the development to success. The team continues to serve the client over a span of 2.5 years for additional support and maintenance in order to perfect the results.

To bring the desired features to reality, we divided the software to five crucial modules:

- Data Protection

- Information Security

- Training Management

- Reporting

We resolved one part at a time to help meet the needs of complete compliance automation software for the bank.

Data Protection

Our compliance management system offers an excellent data protection module. The tailored solution is highly scalable and can be configured individually for complex organizational structures. The software can be used to manage several subsidiaries and branches from the same place. As a result, access to data stays limited to concerned authorities in the process only.

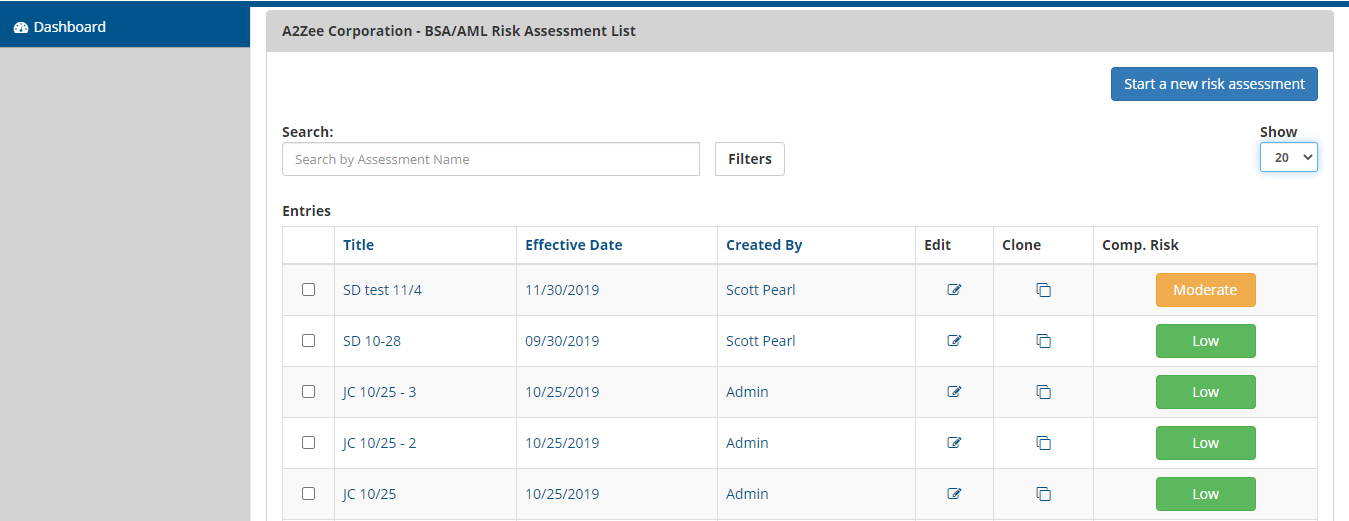

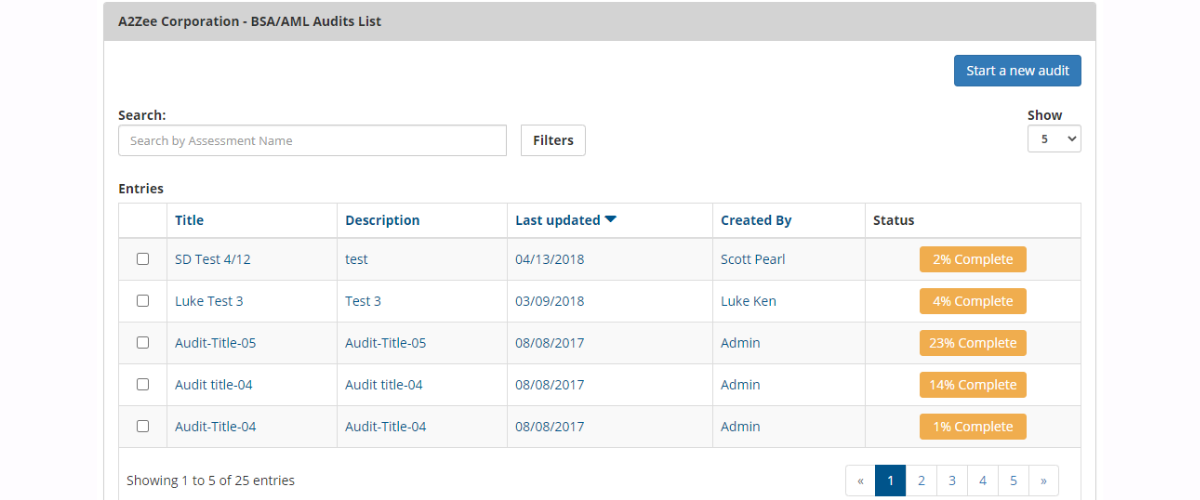

The same can be seen in the following image, where we can find the clients, the risk level, and the compliance authority who created the task.

The software fulfills a SaaS model by establishing a Role-Based Access Control setup on the cloud, allowing your entire staff to stay on the same page. This eventually helps the members to use the shared document for controlling further operations. The following image showcases our modules for a complete audit history and for uploading documents.

The documents uploaded here are accessible to all the members on this software.

The Dashboard alerts the admin of all the changes made in the tasks and the concerned authority who made the changes. In the following audit list, we can find the task name, along with the date when it was last updated and the person behind the changes.

Information Security

Our compliance management software for the bank is completely hosted on the cloud that allows the compliance managers to take control of the software from anywhere and everywhere. Despite that, we have ensured Information Security via dependencies.

The Node Js based solution is backed by AWS Cognito for handling the user accounts and their accessibility to the data. The pair makes it easier for the members to add and perform their tasks remotely and all this can take place, without any security breaches.

Establishing an Information Security Management System was never easy. It is highly complex and confusing at the same time for any organization. Hosting the entire software on the cloud and backing it with the desired security model, however, automates the processes and declutters the complexity involved.

The result of process automation:

- An efficient Risk Analysis

- A Real-time and continuous monitoring

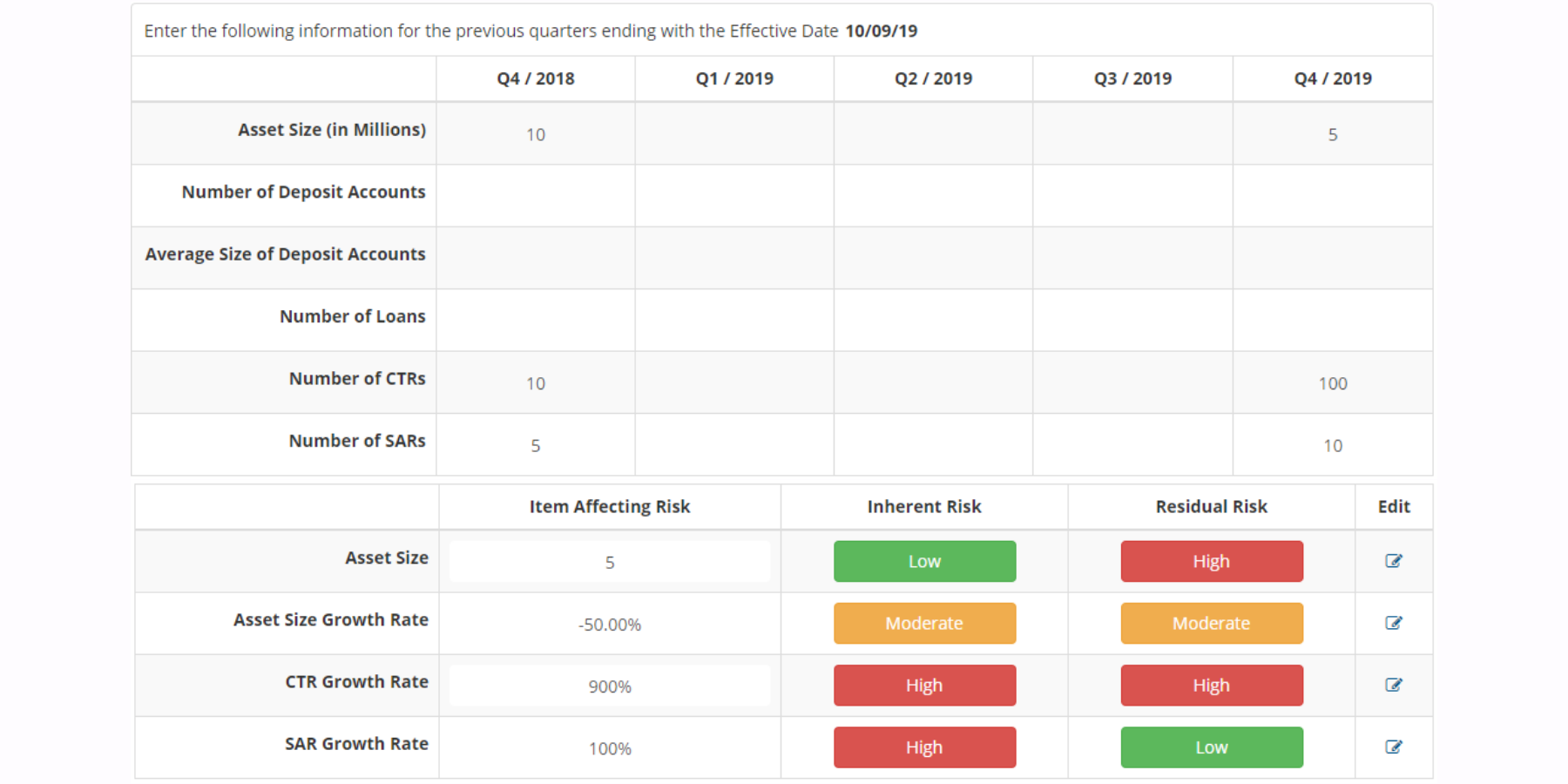

The software is designed with an efficient set of logics to mark the Risk level. The customer can be marked at High, Moderate of Low risk based on the doc provided, and the information provided at the time of analysis.

The overall risk level matters on various factors as mentioned in the previous image. The final risk category is a combination of Inherent Risk and Residual Risk. The Quarterly assessment of the recent past further adds to the risk analysis. In the previous image, we can find the number of CTRs growing from 10 in Q4 of 2018 to 100 in Q4 of 2019. The growth percentage is assessed in the lower half of the image and the risk level is dynamically presented.

The data in the respective quarters can be changed manually, thus affecting the overall risk level.

Training management

Time and again, the compliance managers often need to train the newcomers regarding new updates and policies in compliance management. The custom software designed by us allows the members and the admins to take control of similar assessments for the training sessions.

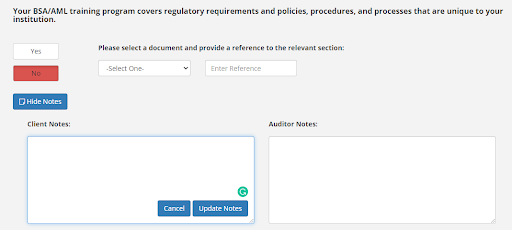

The Gif below shows the Training page of the software

The assessment offers clarity for the training sessions in every term, like:

The organizational roles you train in general:

- Board Members/Senior Management

- Specific positions/Business Functions

- All employees

Additional details of the training program include conducting attendance, training for managing penalties for noncompliance, and covering the likes of regulatory policies.

The training assessment can be furthered with details by custom added notes and documents, as shown in the picture below.

Reporting

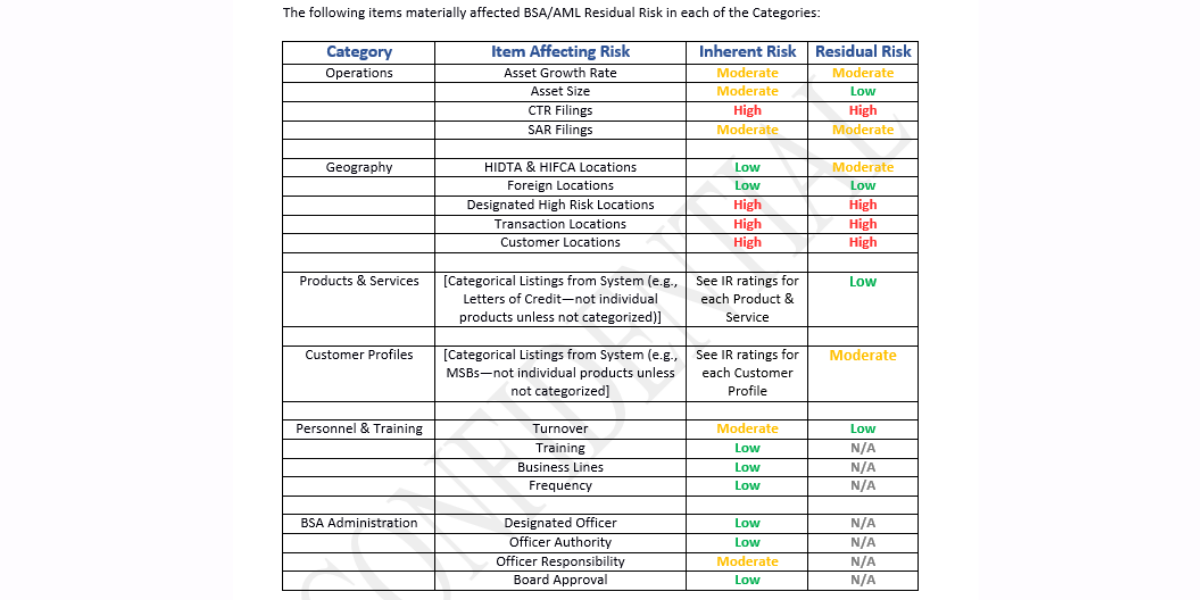

With our custom compliance management software, creating a downloadable report becomes way easier. The software is capable of converting the data availed during the compliance analysis to a readable data format(in Docx extensions). The best part about the feature, all the dynamically raised risk levels are printed as they are.

Here is a sample of a similar report downloaded to the doc file.

It is noticeable that the report accounts for the risk analysis for every category as Inherent as well as Residual Risk.

For this part, we have used the DocxTemplater library. This library is famous for its ability to convert complex script-based data to readable formats. The final report is thus informative and accurate, at the same time.

Our experience at developing the SAAS solutions

With more than ten years of Industrial experience, the NodeJS development agency at The Brihaspati Infotech has worked on several projects where the client seeks for custom needs. Often we are asked to serve them for a longer period helping update their systems and resolving conflicts.

As a leading SaaS development company, we have served various industries that require Role-based access controls, only barred by their own complex processes. Resolving these issues for a variety of business niches allows us to understand the norms of every industry and its verticals.

Our SaaS platform for Boat Owners makes the best example that served a highly complex business process. Our custom SaaS solution transformed the cashflow into a rather automated process.

Our developers are capable of designing similar compliance automation software for banks and several other industries. They will make sure the final software meets the quality standards and offers much-needed security. You can also hire our Angular development team for your dynamic website and relentless maintenance.

Final Words on bank compliance solutions

Organizations are complex, so are the responsibilities of the employees. A timely assessment of the responsibilities is possible with a scalable compliance software by your side. Now that the developers at the Brihaspati Infotech have used Node JS for compliance software development you can contact us directly for a quick project discussion.