Credova Financial – Monthly Installments Solution for Magento 2 Stores

E-commerce has dramatically changed the way retailing is seen. And this goes without saying that it has eventually given rise to several new businesses across the globe. From shipping docks dedicated to e-commerce distribution to new payment methods, the new businesses have earned themselves space both on and off the screens.

In this blog, we will be talking about the financing payment method and how you can empower your Magento store with the hugely demanded service.

According to Business standard, nearly 20% of gross merchandise value is being financed by various credit card companies, banks, and e-wallets.

In fact, 30% of the customer credit shoppers claim that they had rather not shopped if they weren’t offered six-month financing.

The numbers speak quite about the changing needs of the customer and their expectations from their favorite storefronts. What if the customers on your Magento store are hesitating just because of the immediate price of the product? What if allowing your customers to pay the same amount in the next 6 months as small monthly installments help you gain more leads?

Now you can let your Magento 2 customers proceed with monthly installments by integrating Credova extension on your Magento store. And, as the leading Magento development services team, we helped them build this extension for both Magento 1 and Magento 2 based stores. In the coming sections, we will discuss how we achieved this feat at presenting them on the Magento marketplace.

About Credova lease-to-own financing

Credova plays as a middleman between the retailer and the finance providers offering them the right place to find each other. The financial providers can pay the retailers on behalf of the customers. In return, the customers are liable to pay the providers in smaller monthly installments. The duration of the loan can be selected by the customer and, that decides the amount to be paid every month.

Credova extends its support for automobiles to traveling to e-commerce and much more. The e-commerce finance solution takes a check on the credit score of the customers and decides their eligibility for receiving the finance.

Industries that shall look for consumer financing extension

Finance providers often look to help customers, especially when the cost is higher. You can take this to your advantage and allow them to connect with your invaluable customers. While they will push their best top gain new clients, you too have your store’s rise at conversion rates.

With a store that deals with expensive or antique products, you shall immediately allow your users to pay in installments. Here, we enlist a few such products that gain quick financers:

- Paintings

- Statues

- Antiques

- Online boutiques

- Ornaments

- Watches

- Mobile phones/tablets

- Computers/laptop

- Bicycles

- Cameras

- Furniture

And much more. These products gain good customer attention for the luxury they offer, only to be backed off for the huge price they come with. Engage both the parties through a consumer financing extension and enjoy a hike in conversions.

The Working architecture of Payment method extension for Magento 2

1.Collect data about the product

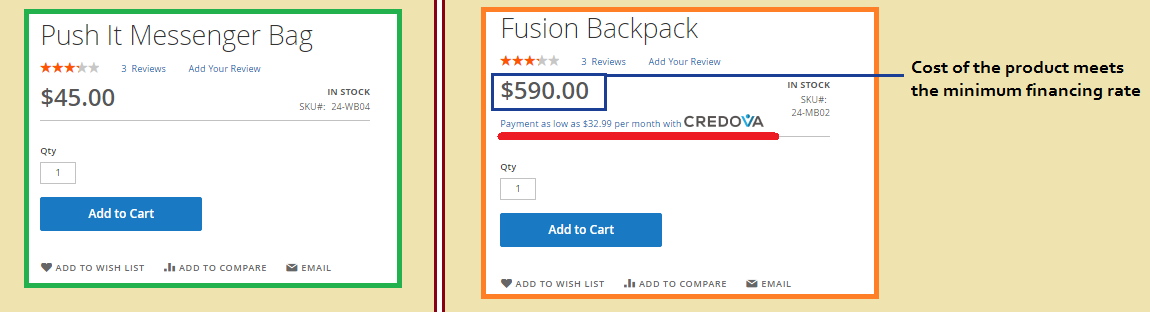

The Credova Magento extension extracts data about the products from the store backend. It collects information like price to enable the financing options for the product. The price is compared with the set criteria followed by the desired option at the storefront.

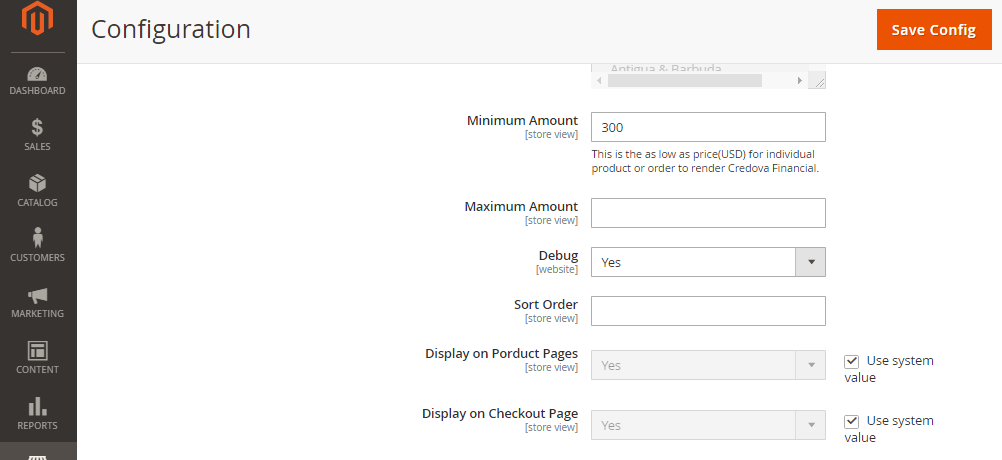

In the picture above, we can see that Credova financing is availed for a product at a higher price. The other one is checked out like any ordinary product. The minimum and the maximum price for qualifying for financing stays with the store admin where he can modify the prices as needed.

2. Take details about the user

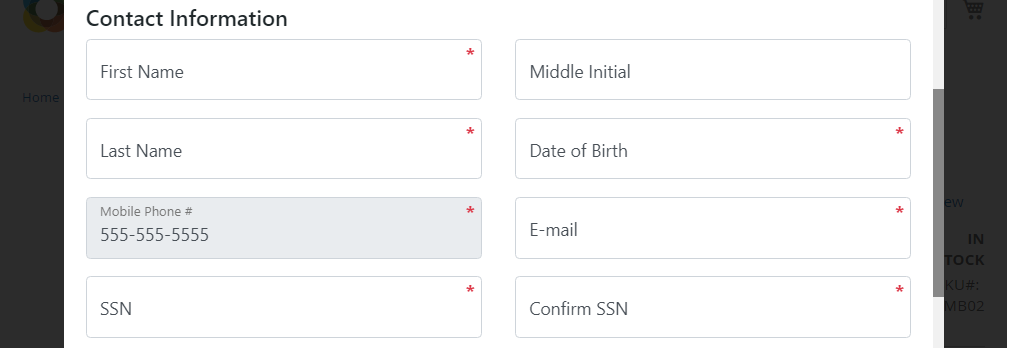

The Credova payment method extension for Magento 2 fetches personal details about the user through contact field form. The form collects data like Name, phone number, and SSN for user verification at the time of checkout.

The acquired phone number is used for logging in the later times and keeps the record of user data.

The details are later used for a credit score check followed by the eligibility for financing.

3. Check if the customer meets the minimal requirements

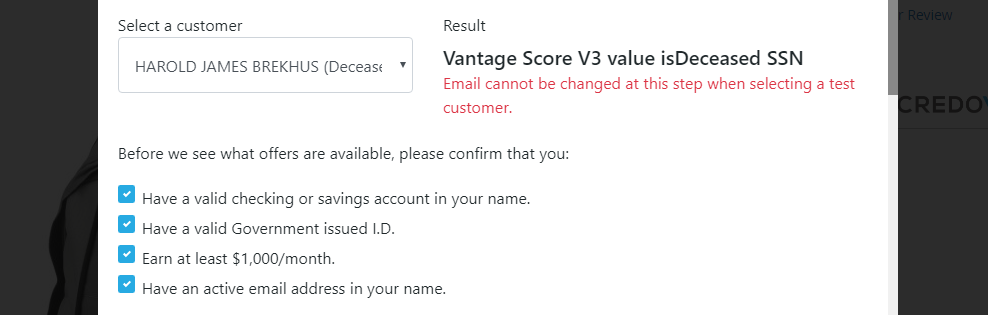

Being validated through third party credit score checks, the extension asks the user to confirm a few more criteria.

- That the users have a valid Bank account to their name.

- Have a government-issued I.D. to their name.

- The minimum monthly salary

- An active Email address to their name

These confirmations are sent to the finance providers on the user’s behalf. Failing in any of the conditions stops the user from proceeding with the financing process.

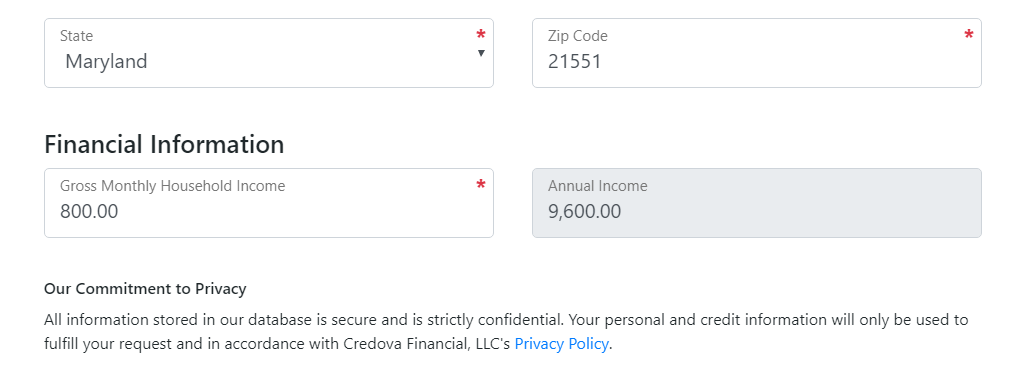

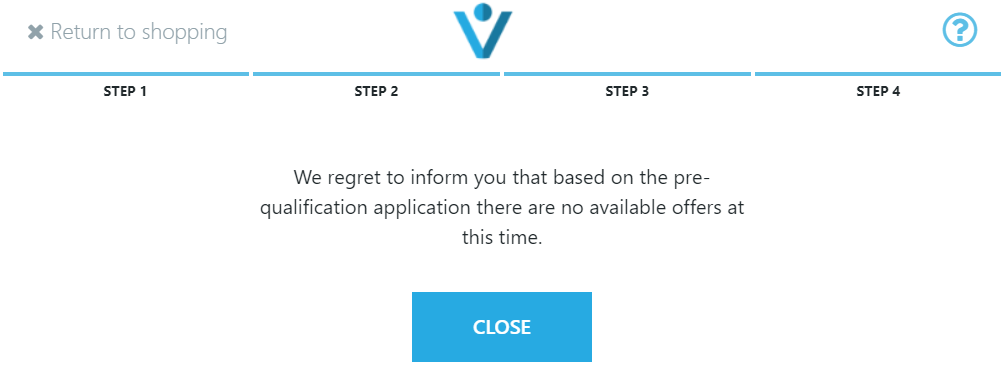

In the pictures above, we can see that the minimum monthly salary stays above $1000, while the user fails to make the mark. As a result, the Credova extensions stops the user thereon with the error message as shown below:

4. Select the best finance provider from the list

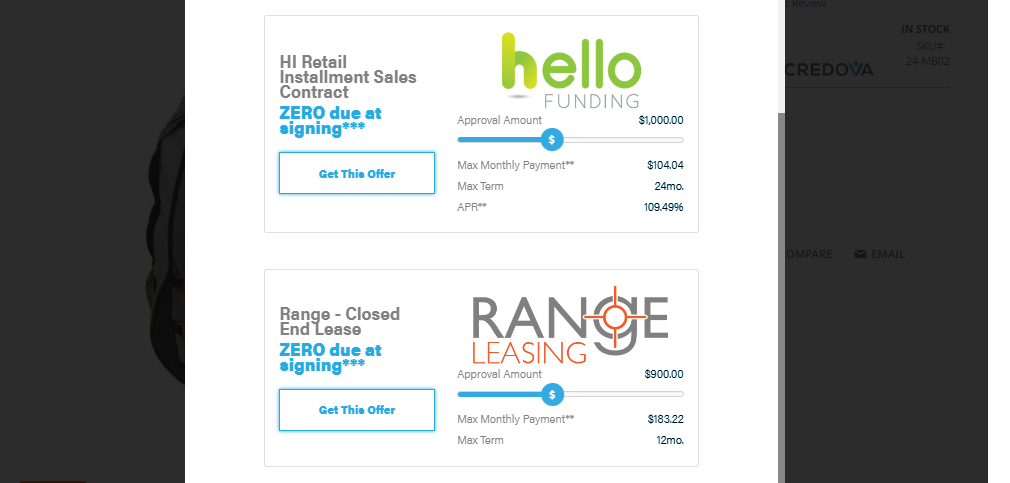

The custom payment method extension for Magento 2 leads the user for Credit approval from financing companies. The companies have their own set of monthly installments for the loan amount. The user can select the loan amount and the monthly payment options from easy to handle sliders.

In the picture above, we can see financers offering consumer financing for varying amounts and monthly payments for any approved user. The user can avail themselves of the desired loan as instant credit decisions. Being Approved with a good credit score, the financers pay on their behalf.

Implementations for the Custom payment method extension for Magento 2

On our way to develop a successful extension for availing finances, we faced obstacles on several grounds. The first one was, of course, the differences in platforms. Magento 1 and Magento 2 are meant to work differently. The extension thus needed to be flexible to fetch data from both the Magento versions equally well. Apart from that, we had a few more concerns to resolve:

Financing products that meet the criteria

As we have explained earlier, the financing option is only available for limited products that sufficiently meet the criteria. Thus, we had to set up filters where the option avails itself. We added a set of the price range. Only the products that exceed the minimum price amount qualify for financing.

But, then again, every store varies from the other. The price range varies as well. We rather came up with the idea to avail customizable filters at the backend.

In this picture, we can see the Magneto 2 backend of the Credova extension that lets the store admin control the price range. The extension collects the cost of the product from the store and checks if it lies in the given range followed by the addition of financing options at the storefront. Added to that, the users can choose to display the financing on the product page/checkout page or both.

A similar panel is added at the back end of the Magento 1 store, allowing the store owners to manage consumer financing.

That being said, the Credova extension on Magento could prove to be a great extension for the Magento 1 and Magento 2 stores for gaining new customers and retaining the existing ones.

Our experience with custom Magento development and payment gateways

As the leading Magento development service provider, The Brihaspati Infotech has gained a good name across the globe. With 9+ years of experience at handling several projects in this technology, we have helped our clients experience their dream e-commerce store. The number of satisfied reviews we have received in these years, speak for themselves.

As of developing a payment gateway, we had our hands on Shopify Payment Gateway Development for Paycertify where our Shopify developers enabled the Shopify stores to get paid through Paycertify.

Final words on Consumer financing extension

Developing a payment gateway for consumer financing surely offered a few obstacles at every stage. A faultless extraction of data at the ends is equally important. However, that is where a panel of expert Magento developers comes into play. They see past the obstacles to help you achieve your expectations with ease.

If your business offers similar features where you can gain customers through Magento store owners, the very way such Payment gateways exist, you can have us contacted. We can help you get an extension on any major e-commerce app store.